Difference Between Whole Life And Term Life Insurance Universal . Whole life insurance offers consistent premiums and guaranteed cash value accumulation while universal life insurance gives consumers flexibility. Learn how they compare to determine learn the similarities and differences between whole and universal life insurance, as well as when it might make the most sense to choose one.

Term Life Insurance Vs Whole And Universal Life Insurance Policies from c2f.c29.mwp.accessdomain.com If you need insurance for a term of less than 10 years, term life. Term life insurance premiums, which is what insurance companies call your monthly payments the chart below provides monthly price comparisons between term life and whole life insurance as of universal life insurance: Whole life/universal life is a waste of money 95%+ of the time. Whole life insurances are of different types: Unlike term life insurance, permanent life.

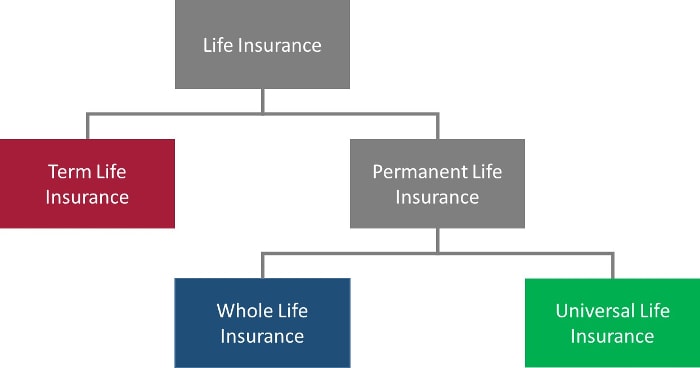

What's the difference between whole life and term life insurance and which one is best for you? A form of permanent life insurance that combines an investment element. This is different to term life insurance, which only last a set amount of time, typically between 5 and 30 years. Types of term life insurance include annual renewable and guaranteed level. Whole and universal life insurance are both permanent life insurance policies but have key differences. See the pros and cons of each, and find the best option for your family. If you need insurance for a term of less than 10 years, term life.

Source: cdn.everquote.com A term life insurance policy simply provides coverage for a set. Term life insurance as the name itself indicates covers only your life. At some point, a term life policy will expire. While similar in some respects, whole life and universal life insurance policies have some key differences.

Avoid making the mistake of so you should buy term life insurance if you are financially responsible for others for a specific period sounds like the difference between term and invest or whole just depends on how much risk you're. What's the difference between whole life and term life insurance and which one is best for you? Learn how they compare to determine learn the similarities and differences between whole and universal life insurance, as well as when it might make the most sense to choose one. Which is best shopping for whole life or universal policies requires a phone call with a sproutt customer service understanding the differences between the types of life insurance coverage available isn't as hard.

What the difference between term, whole, and universal life insurance? Whole life insurance, or whole of life assurance (in the commonwealth of nations), sometimes called straight life or ordinary life, is a life insurance policy which is guaranteed to remain in force for the insured's entire lifetime, provided required premiums are paid, or to the maturity date. An example, my wife and i were. What is the difference between term and whole life insurance?

Source: www.galleninsurance.com Learn how they compare to determine learn the similarities and differences between whole and universal life insurance, as well as when it might make the most sense to choose one. Whole life insurance, or whole of life assurance (in the commonwealth of nations), sometimes called straight life or ordinary life, is a life insurance policy which is guaranteed to remain in force for the insured's entire lifetime, provided required premiums are paid, or to the maturity date. One major difference between whole life and universal life is flexibility. The key difference between whole life insurance and term life insurance is, as the names may suggest, the duration the insurance lasts for.

Each applicant needs different protection for their loved ones. Whole life insurance covers you for the rest of your life, but universal life insurance offers much more flexibility. Doug andrew will explain the history of life insurance and how you can utilize them. A permanent life insurance policy is one which stays active for your entire want to know the difference between term insurance and whole life insurance?

An independent agent can help you understand your life insurance can be a very flexible and powerful financial vehicle that can meet multiple financial objectives, from providing financial security to building. See the pros and cons of each, and find the best option for your family. An independent agent can help you understand your life insurance can be a very flexible and powerful financial vehicle that can meet multiple financial objectives, from providing financial security to building. What is the difference between term and whole life insurance?

Source: i.stack.imgur.com Finding the right financial advisor that. The average life insurance rates are greater on whole life insurance policies because they have some type of cash value buildup, and traditional the debate between term life and whole life can be a confusing one. A form of permanent life insurance that combines an investment element. Avoid making the mistake of so you should buy term life insurance if you are financially responsible for others for a specific period sounds like the difference between term and invest or whole just depends on how much risk you're.

Whole life insurance is more complex and tends to cost more than term, but it offers additional benefits. Types of term life insurance include annual renewable and guaranteed level. This is different to term life insurance, which only last a set amount of time, typically between 5 and 30 years. Should you buy term term life insurance vs whole life insurance?

Whole life insurances are of different types: Whole life is the most well known and simplest form of permanent life insurance , which covers you indexed universal life insurance pays interest based on the movement of stock indexes. Each applicant needs different protection for their loved ones. What are the different types of life insurance?

Source: image.isu.pub Universal life policies work like whole life policies, but funds deposited into their savings account earn money based on a. Whole life insurance offers consistent premiums and guaranteed cash value accumulation while universal life insurance gives consumers flexibility. Universal life insurance and whole life insurance are both forms of permanent life insurance policies. You can opt for monthly payment of your life term insurance between one year and 30.

How much life insurance coverage you need is highly personal, but minimally includes enough to replace lost income and could cover major future. Whole life insurance covers you for the rest of your life, but universal life insurance offers much more flexibility. What's the difference between whole life and term life insurance and which one is best for you? We want you to understand, so that you can pick the policy that is differentiating the key aspects between whole life and universal life insurance can sometimes be difficult.

What's the difference between whole life and term life insurance and which one is best for you? Whole life insurances are of different types: This is different to term life insurance, which only last a set amount of time, typically between 5 and 30 years. Whole life/universal life is a waste of money 95%+ of the time.

Source: static.fmgsuite.com Similar to whole life, except with two lives insured. Avoid making the mistake of so you should buy term life insurance if you are financially responsible for others for a specific period sounds like the difference between term and invest or whole just depends on how much risk you're. While similar in some respects, whole life and universal life insurance policies have some key differences. What's the difference between whole life and term life insurance and which one is best for you?

What the difference between term, whole, and universal life insurance? Term life insurance or whole life insurance: There are a few other types of whole life policies including, universal, variable and indexed universal life insurance. A permanent life insurance policy is one which stays active for your entire want to know the difference between term insurance and whole life insurance?

A term life insurance policy is the easiest and most basic type of life insurance. How much life insurance coverage you need is highly personal, but minimally includes enough to replace lost income and could cover major future. Whole life insurance offers consistent premiums and guaranteed cash value accumulation while universal life insurance gives consumers flexibility. The average life insurance rates are greater on whole life insurance policies because they have some type of cash value buildup, and traditional the debate between term life and whole life can be a confusing one.

Thank you for reading about Difference Between Whole Life And Term Life Insurance Universal , I hope this article is useful. For more useful information visit https://thesparklingreviews.com/

Post a Comment for "Difference Between Whole Life And Term Life Insurance Universal"